December 14, 2017

The Council’s International Working Group came together this fall for a stimulating conversation on global trends in insurtech and discussed how brokers can effectively leverage this disruption. Recent technology and innovation has reshaped our understanding of the globalized economy and of how consumers procure goods and services. The shared economy – the “shareconomy” – of exchanging assets for a fee and collaborative consumption (or short-term consultancy contracts) across multiple jurisdictions became a norm, which influences how we approach associated risks.

Insurtech companies have been at the forefront of transforming traditional risks into on-demand insurance products to meet clients’ changing, isolated needs. The mobile platform, designated to provide more effective and seamless prospecting, servicing and client interface, is at the foundation of this change. As a result, many insurtech investments aim at closing existing gaps between serving clients’ needs and mobile channels.

On the global scale, insurtech’s progress in various countries largely depends on a specific country’s culture of innovation, level of insurance sector development and adoption of technology. If we take insurtech investment as a key measure, the U.S. stands as an unquestionable leader by claiming 60 percent of $1.7 billion in sectoral investment in 2016.

While this leadership in the U.S. is not surprising, the rankings of China and India, which received as much funding as more mature markets of Germany and the U.K., are remarkable. Indeed, emerging markets, free of legacy systems, embraced easily mobile technology and advanced in developing new products and distribution channels. Experts suggest that insurtech holds much promise for these markets and can make them new insurance hubs to rival with developed countries.

Time will tell which countries will become insurtech leaders, but on the micro level, brokers must not lose sight of innovation and must continue to engage with insurtech to stay on top in their respective markets. Insurtech startups view insurance distribution as a niche to exploit, which creates vast opportunities for improvement and potential frictions with brokers. At the same time, there are numerous examples of insurtech startups’ effective cooperation with incumbents. As experience shows, players that address this disruption by incorporating innovation into core strategies will maintain customers’ trust and have a shot at staying relevant.

Survey Results

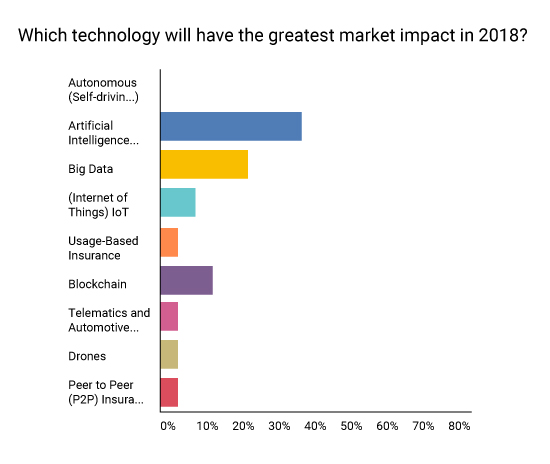

In the last spotlight newsletter, we asked readers to select the insurtech area that they think will have the greatest market impact in 2018. Artificial intelligence was the winner, with big data and blockchain coming in second and third.

Stay tuned for the next Insurtech Spotlight on Aritifical Intelligence (AI) Innovation.

What We’re Reading

Welcome to New IoT: ‘Insurance of Things’

IoT has become mainstream through wearable devices and connected homes/properties providing an immense amount of data that will continue to shape the insurance industry.

Talking Blockchain with The Institutes’ RiskBlock Alliance leader

Christopher McDaniel, executive director of RiskBlock Alliance, discusses RiskBlock’s differentiators such as being blockchain agnostic, their “use it and lose it” data policy and an open framework for custom built applications.

Understanding the Impact of Emerging Tech on Insurance

The insurance industry is well aware of the technology innovation taking place with various stakeholders engaging at different levels. It is key to understand which areas of the business have the greatest potential to leverage technologies and to account for adoption timeframe.