November 8, 2018

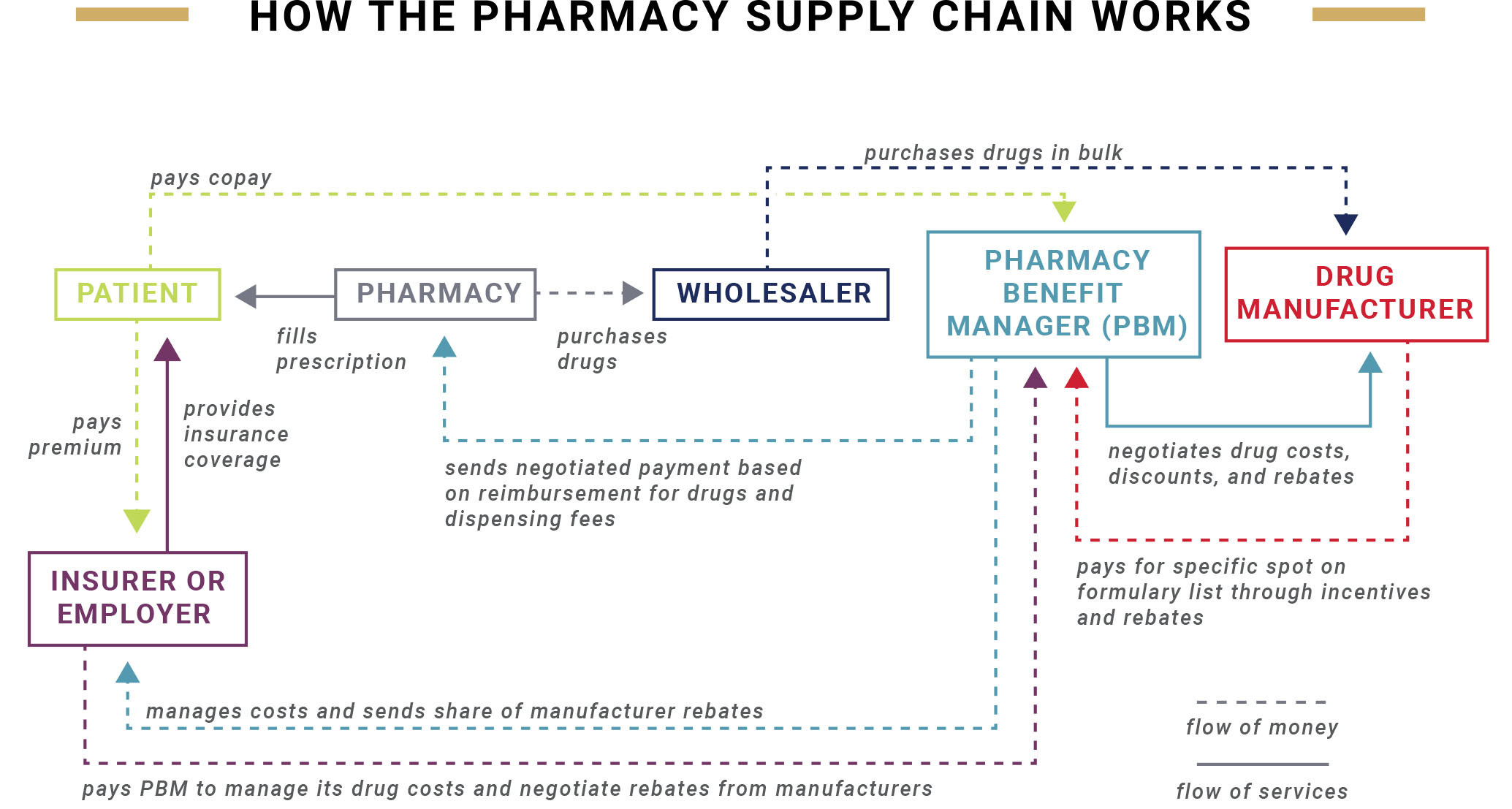

Despite the Trump administration’s push to lower drug prices, costs have not yet decreased. Lack of consensus regarding how to approach the complex pharmacy supply chain has prompted debate about the most effective way to lower drug costs, including who’s to blame. However, focusing on one entity instead of the entire supply chain may limit how costs and solutions are discussed. Below, we explore the flow of drugs, services and money.

Click here for a look at the flow of services, and click here for the flow of money within the pharmacy supply chain.

Pharma facts:

- Intermediaries, including insurance companies, PBMs, pharmacies and wholesalers, together earn as much revenue as a drug manufacturer. Manufacturers traditionally spend about a decade developing a drug.

- Insurance coverage may be defined by the amount manufacturers pay to PBMs to incent them to move their particular drug to a desired position on a formulary list, instead of which drugs patients prefer or the value and efficiency of a drug.

- Insurance companies have been vertically integrating within the pharmacy space. Now that the Aetna-CVS merger has been approved, CVS will have a stake in all levels of the supply chain except wholesale. Here are major healthcare companies taking on multiple roles in the supply chain.

- By 2020, U.S. pharmacy spending is anticipated to reach $500B, which has spurred the formation of startups aiming to simplify the drug supply chain. They’re doing that through transportation, technology (like Blockchain), pricing negotiations and transparency tools as well as a direct-to-consumer mindset. Here is where the pharmaceutical industry is investing.