NEWS RELEASE – FOR IMMEDIATE RELEASE

Contact: Brianne Spellane

Director of Communications & Content Strategy

202.662.4303

brianne.spellane@ciab.com

P/C MARKET SEES DOWNWARD TREND FOR NINTH STRAIGHT QUARTER,

ACCORDING TO CIAB MEMBER SURVEY

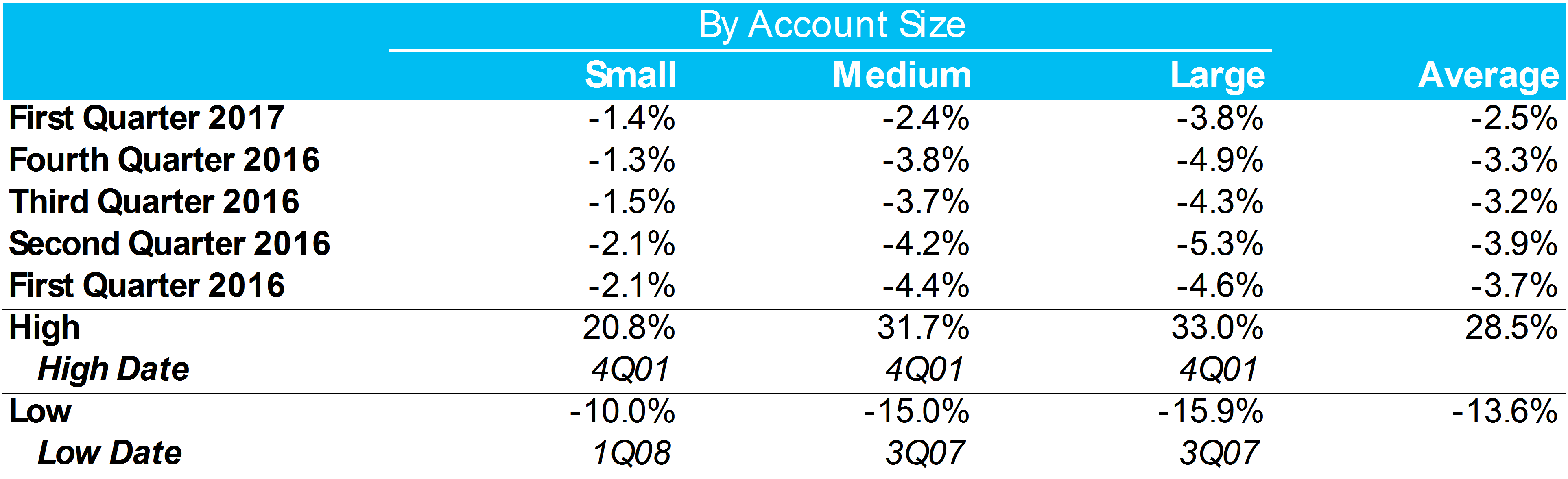

WASHINGTON, D.C. – May 9, 2017 – Commercial property/casualty (P/C) rates remained competitive in Q1 2017, with the average rate decline across all accounts at 2.5 percent, compared to 3.3 percent in Q4 2016, according to The Council of Insurance Agents & Brokers’ Commercial P/C Market Survey.

The soft market saw a decline in rates for the ninth straight quarter across small, medium and large accounts. Premium pricing saw its greatest decline throughout 2016, but has since begun to stabilize in 2017.Once again, large accounts saw the greatest rate decrease at 3.8 percent. An increase in new and expanding market entrants and aggressive underwriting led to a competitive first quarter.

Rate change by line of business also saw similar rate decreases, with the exception of commercial auto, which has been a consistent trend since Q3 2011. “Automobile is the only line of business under stress,” explained one respondent from a small regional-sized firm in the mid-east. “Premium increases in this line are being offset by the other lines resulting in flat–to-small single digit increases in the overall account premium.”

Average First Quarter 2017 Commercial Pricing Declines

Source: The Council of Insurance Agents & Brokers. Chart prepared by Barclays Research.

Source: The Council of Insurance Agents & Brokers. Chart prepared by Barclays Research.

“Commercial premium pricing this quarter was consistent with what we saw in 2016,” explained Ken A. Crerar, President/CEO of The Council. “The market remained soft across most lines of business. Poor loss ratios in commercial auto continued to drive pricing upward, a trend we continued to see in accounts of all sizes for that particular line.”

Market Trends in Q4 2016 – The Market Remains Competitive

When asked about general changes in the market over the last three months, respondents noted that while there were no major shifts, the soft market has contributed to intense competition for new business, pressure to retain clients and aggressive underwriting.

Top of Mind

When asked which business issues kept respondents up at night, talent management once again led the way. Price competition/excess capacity came next. Market uncertainties regarding health insurance reform and the client experience tied at third. Respondents were also asked about their organization’s top investments and the consensus was largely talent and technology, which was similar in 2016. Hiring and training client-facing roles, leveraging data analytics, modernizing claims and risk management processes, and creating partnerships with non-insurance advisory solutions were all top-of-mind mentions.

Looking Forward

As 2016 came to a close, respondents were optimistic regarding the Trump administration when asked about its potential effects on the way customers purchase P/C insurance. While the majority of respondents agreed that not much has changed over the past three months in 2017, many remain optimistic that economic growth and less regulation on business could lead to a greater demand for insurance as well as opportunities for business expansion. Respondents also noted the convergence of insurance and technology as both a challenge and opportunity, saying that brokers must understand and embrace emerging technologies and new business models in order to deepen their advisory capabilities and client relationships.

To see the full results, click here.

The Council’s survey is the oldest source of commercial property/casualty market conditions, pricing practices and trends, dating back to 1999.

________________________

The Council of Insurance Agents & Brokers is the premier association for the top regional, national and international commercial insurance and employee benefits intermediaries worldwide. Council members are market leaders who annually place 85 percent of U.S. commercial property/casualty insurance premiums and administer billions of dollars in employee benefits accounts. With expansive international reach, The Council fosters industry wide relationships around the globe by engaging lawmakers, regulators and stakeholders to promote the interests of its members and the valuable role they play in the mitigation of risk for their clients. Founded in 1913, The Council is based in Washington, D.C.