November 30, 3017

EXECUTIVE SUMMARY

The following are key takeaways from The Council of Insurance Agents & Brokers’ Commercial Property/Casualty Market Index Q3 2017 (July 1 – September 30):

- Overall, it was still a buyers’ market in the United States, with an inconsistent approach. Demand, underwriting and claims varied across lines of business.

- By account size, average premiums declined by 1.3 percent, the smallest decrease throughout the past 11 quarters.

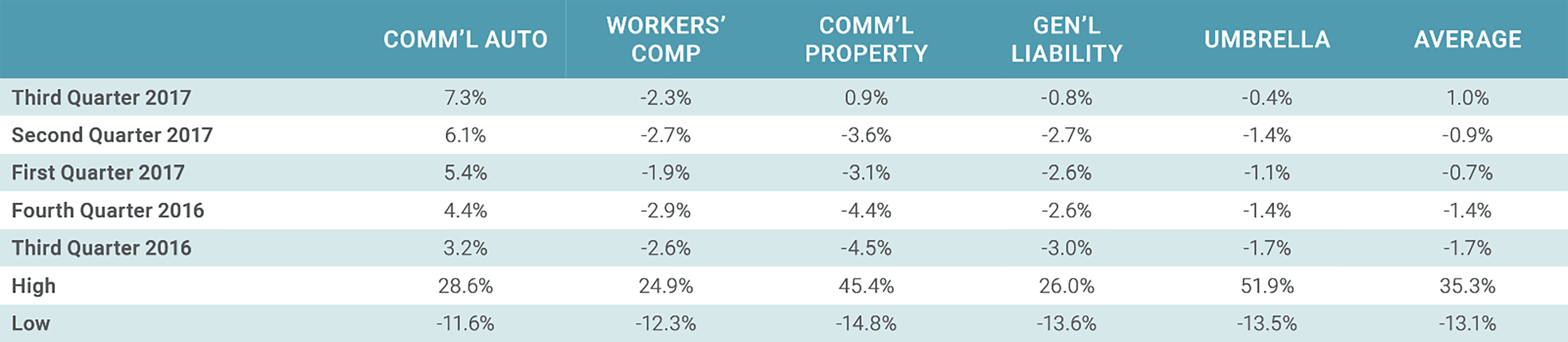

- By line of business, average premium for five major commercial property/casualty (P/C) lines increased for the first time (one percent) in 11 quarters. This increase, however, was driven by the tightening Commercial Auto line, a steady trend throughout the past 25 quarters.

Rate Change for Major Lines Ranged From -2.3% to +7.3% in Q3 2017

- Fifty-nine (59) percent of brokers reported an increase in the number of Flood claims and sixty-four (64) percent of brokers saw an increase in demand for Flood coverage.

- Eighty-one (81) percent of all brokers reported an increase in demand for Cyber coverage.

- Across all sized accounts, respondents reported that underwriting practices remained relatively similar to that of last quarter, except for two new trends: automated underwriting of small accounts and tightening underwriting for Commercial Auto.

To see the full Commercial Property/Casualty Market Index Q3 2017, click here.

To read the press release, click here.

Further insights including market developments in cyber, data analytics and top challenges/opportunities are being created exclusively for members who participated in the survey. To obtain, or to ensure you are on the list to participate for Q4, please contact The Council’s Kim Do at [email protected].